Updated on August 22, 2023

Discover the Homestead Declaration, a crucial protective measure designed to safeguard the property and financial interests of homeowners in California. This legal document, also referred to as a Homestead Exemption, serves as a vital shield against creditor claims, ensuring the security of a homeowner’s cherished dwelling.

By officially filing the Homestead Declaration at the county recorder’s office, homeowners can establish essential legal provisions that protect their real property and grant them exemptions from property taxes. Our comprehensive guide delves into the significance of the Homestead Declaration, the associated fees, and addresses other important questions to aid you in navigating this fundamental aspect of property ownership, all in accordance with California state law.

A couple of weeks ago, we wrote a blog on what the Purpose of a Homestead was, which was part one of the Homestead series. This is part two of the two-part information series regarding the homestead. The first part served as a general introduction to homestead, and briefly covered the topic of the automatic exemptions and the declared exemptions in a homestead.

This second part gets into the Homestead exemption amounts and some of the key differences between the automatic homestead and the declared homestead.

Key Takeaways:

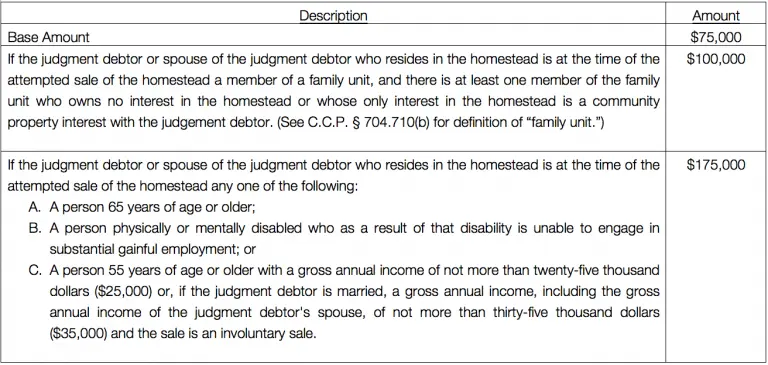

Whether you elect to declare a homestead or you take rights under the automatic homestead, pursuant to California Code of Civil Procedure § 704.730 the homestead exemption amounts are as follows:

A declared homestead status arises when the declaration is properly drafted and recorded. (See C.C.P. §§ 704.910 & 704.920.) On the other hand, the automatic homestead requires the following:

(See C.C.P.§ 704.710(c).) Thus, the declared homestead protects the homeowner even if the homeowner moves. (C.C.P.§ 704.920.) The automatic homestead does not have the same flexibility. (See C.C.P.§ 704.710(c).) Other differences between the declared and homestead exemptions include:

a. The surviving spouse of the decedent.

b. A member of the family of the decedent.

If you are interested in declaring a homestead a good place to start is by reviewing the requirements of C.C.P. § 704.930. Our real estate attorneys at Schorr Law have a great deal of experience with real estate matters and disputes. To see if you qualify for a free 30-minute consultation, contact Los Angeles probate litigation lawyer today. Text: (310) 706-2265 | Call: (310) 954-1877 | Email: [email protected] | Send us a Message!