Updated on April 1, 2024

When it comes to owning real estate in California, there are two common ways that individuals can hold title to a property: Joint Tenancy and Tenancy in Common. While these terms may sound similar, they have distinct legal implications that can have a significant impact on your rights and obligations as a property owner.

In this article, we will explore the key differences between Joint Tenancy and Tenancy in Common, and help you determine which option is best suited for your specific situation.

Firstly, Let’s start with the basic definitions:

Joint Tenants is a form of property ownership where two or more individuals own property together with equal rights. It is characterized by the “right of survivorship,” meaning when one owner passes away, their share of the property automatically transfers to the surviving owners. This process is known as the “right of survivorship.” Joint Tenancy is commonly used for married couples or family members who want to ensure that the surviving owner(s) will inherit the property without the need for probate.

Common Use: This form of ownership is popular among married couples or family members, as it ensures that the property passes to the surviving owner(s) without the need for probate.

Legal Implications: In Joint Tenancy, each owner has an undivided interest in the entire property. The right of survivorship is a key feature, bypassing the probate process and directly transferring ownership to the surviving joint tenants.

Advantages:

Disadvantages:

Tenants in Common is a way of holding title where two or more individuals own property together, but with separate and distinct shares. Each owner can sell, transfer, or mortgage their share independently. In the event of an owner’s death, their share of the property passes to their heirs or beneficiaries as directed by their will or through intestate succession.

Common Use: This is often used by business partners, friends, or investors who wish to own property together while maintaining separate control and ownership over their respective shares.

Legal Implications: Upon the death of an owner, their share passes to their heirs or as directed by their will, rather than automatically transferring to the other owners. This allows for more flexibility in estate planning.

Advantages:

Disadvantages:

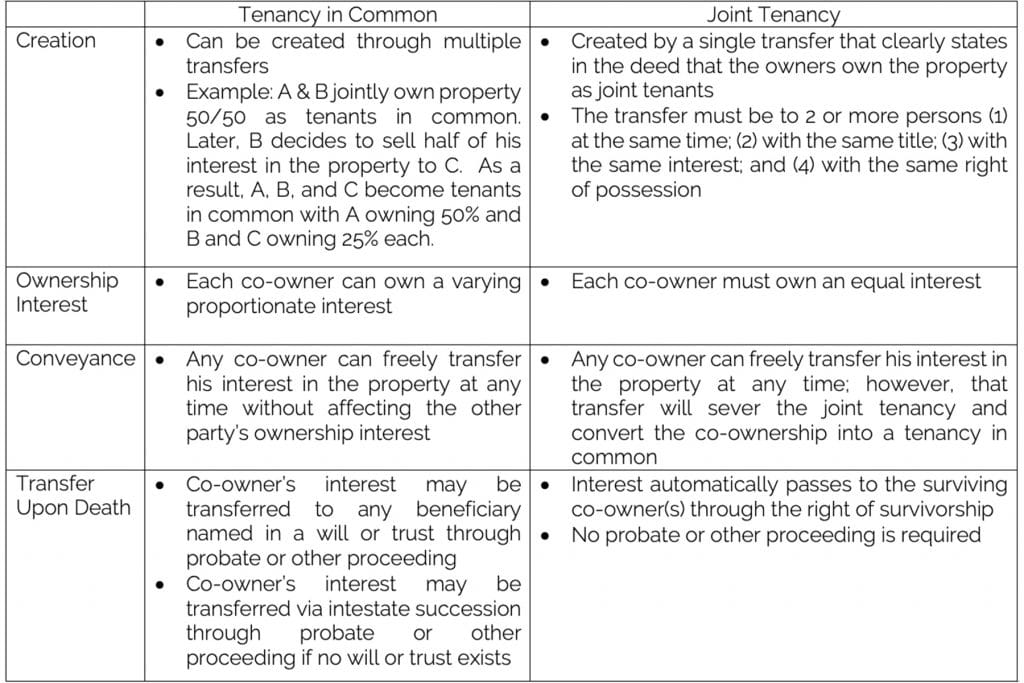

The two most common ways to jointly own property with one or more persons in California are joint tenancy and tenancy in common California law. The default method of co-ownership is actually tenancy in common California. In other words, unless the deed specifically states the method of co-ownership, the co-owners will hold title as tenants in common California. Accordingly, it is important to specify the method of co-ownership in the deed, especially if the co-owners do not want to own the property as tenants in common. (Click here to read about the differences between deed and title)

A few of the similarities and differences between these two methods of co-ownership are explained below.

● Each owner has an equal right to possess, use, and benefit from the entire property

● Each owner is responsible for their proportionate share of the expenses of the property, including payments of mortgage, maintenance, property taxes, insurance, etc.

● Each owner is entitled to their proportionate share of income from the property, such as rental income

● Each owner has a right to encumber their separate interest in the property without affecting the co-owner(s) interest(s)

Accordingly, one of the main issues to consider when deciding whether to jointly own property as tenants in common California or joint tenants is how the owner’s interest will transfer upon death.

For example, if a husband and wife or parent and child jointly own property, then holding title as joint tenants is preferable as the decedent’s interest will automatically transfer to the surviving co-owner without the hassle of going through probate or other proceeding. However, if friends or siblings jointly own property, then holding title as tenants in common may be preferable so that each owner can dictate who will receive their interest in the property when they die.

Q1: Can a joint tenancy be converted into a tenancy in common?

Yes, a joint tenancy can be converted into a tenancy in common through a process called “severance,” which typically involves one of the joint tenants transferring their interest to themselves or another party.

Q2: How is the sale of property handled in tenancy in common?

In tenancy in common, each owner can sell or transfer their individual share independently. However, selling the entire property usually requires agreement from all co-owners or a court order.

Q3: What happens if a joint tenant wants to sell their share?

In joint tenancy, an individual cannot sell their share without the consent of the other joint tenants. Selling or transferring their share will typically convert the joint tenancy into a tenancy in common for that share.

Q4: How are expenses and profits divided in tenancy in common?

In tenancy in common, expenses and profits are typically divided according to each owner’s share in the property, which may not necessarily be equal.

Q5: Is joint tenancy a good option for unmarried couples?

Joint tenancy can be a good option for unmarried couples as it allows for the right of survivorship, ensuring that the property passes directly to the surviving partner without probate.

Q6: Can creditors of one tenant in common claim against the property?

Creditors of one tenant in common can claim against that tenant’s share of the property, but not against the shares of the other owners.

The Schorr Law real estate attorneys have a great deal of experience dealing with tenancy disputes, partition actions, and quiet title actions as well. We frequently deal with disputes concerning ownership of real property regardless of whether a party is arguing actual ownership is accurately reflected by record title. To schedule a consultation with one of our attorneys, contact us today.

See related blog posts: What Happens to Property After the Death of Joint Tenants